Iconic household brands under one banner in $74 billion takeover

Kimberly-Clark is buying Tylenol maker Kenvue in a cash and stock deal worth about $US48.7 billion ($74.49 billion), creating a massive consumer health goods company.

Shareholders of Kimberly-Clark will own about 54 per cent of the combined company. Kenvue shareholders will own about 46 per cent in what is one of the largest US corporate takeovers this year.

The combined company will have a huge stable of household brands under one roof, putting Kenvue's Listerine mouthwash and Band-Aid side-by-side with Kimberly-Clark's Cottonelle toilet paper, Huggies and Kleenex tissues. It will also generate about US$32 billion ($48.95 billion) in annual revenue.

READ MORE: New US poll deals major blow to Donald Trump

Kenvue has spent a relatively brief period as an independent company, having been spun off by Johnson & Johnson two years ago.

J&J first announced in late 2021 that it was splitting its slow-growth consumer health division from the pharmaceutical and medical device divisions.

Kenvue has since been targeted by activist investors unhappy about the trajectory of the company and Wall Street appeared to anticipate some heavy lifting ahead for Kimberly-Clark.

Shares of Kimberly-Clark, based just outside of Dallas, slumped more than 13 per cent on Monday local time.

Kenvue's stock jumped more than 14 per cent.

READ MORE: How pregnant British teen went from Thai holiday to jail in Georgia

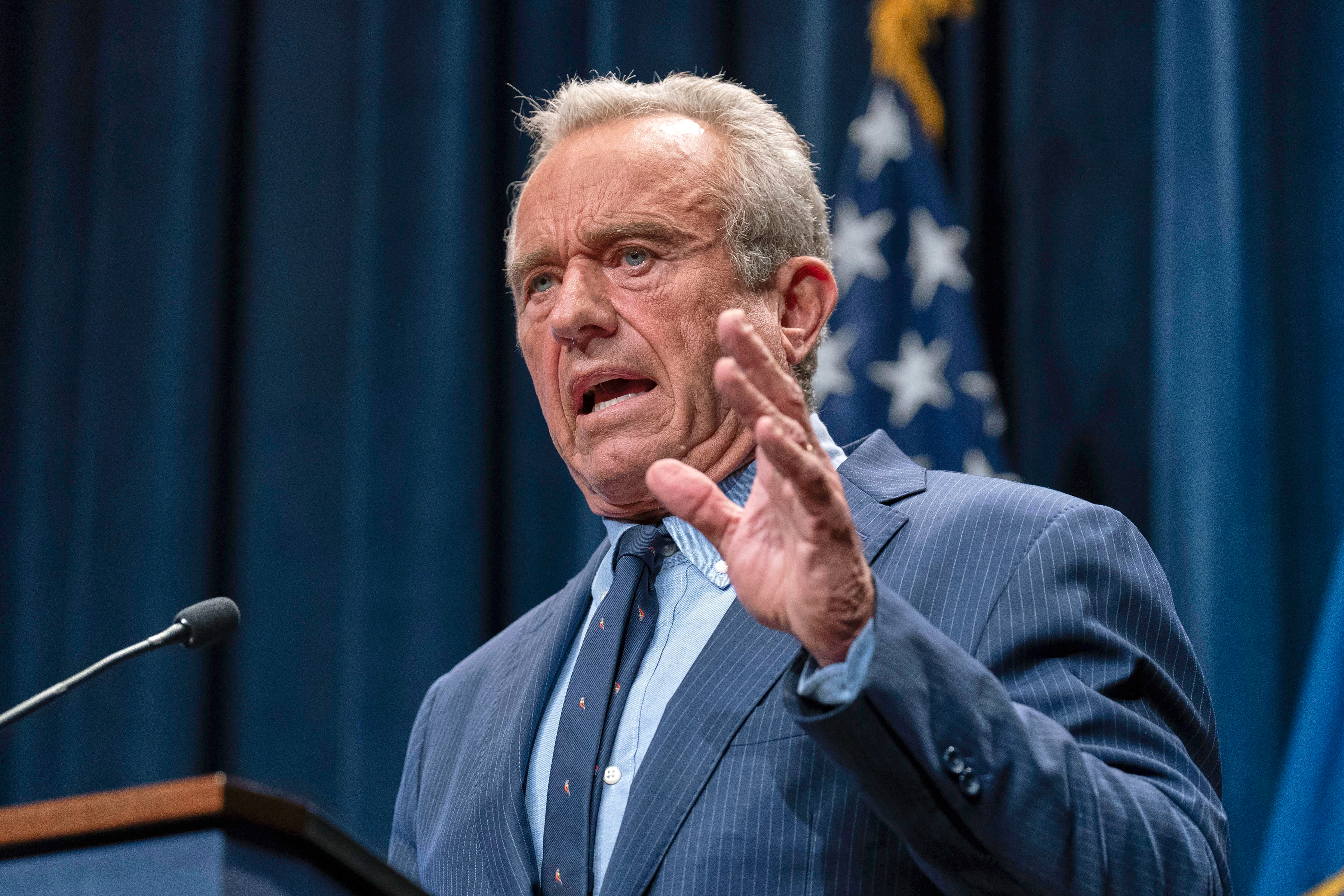

Kenvue and Tylenol have been thrust into the national spotlight this year as President Donald Trump and Health Secretary Robert F. Kennedy Jr promoted unproven and in some cases discredited ties between Tylenol, vaccines and the complex brain disorder autism.

Trump then urged pregnant women against using the medicine.

That went beyond US Food and Drug Administration advice that doctors "should consider minimising" the painkiller acetaminophen's use in pregnancy – amid inconclusive evidence about whether too much could be linked to autism.

Kennedy reiterated the FDA guidance during a press conference last week. He said that there isn't sufficient evidence to link the drug to autism.

READ MORE: Medieval tower in Rome collapses during renovations, injuring worker

"We have asked physicians to minimise the use to when its absolutely necessary," he said.

Kenvue has continued to push back on the Trump administration's public statements about Tylenol and acetaminophen, the active ingredient it contains.

"Nothing is more important to us than the health and safety of the people who use our products," Kenvue said in a statement on its website.

"We believe independent, sound science clearly shows that taking acetaminophen does not cause autism.

"We strongly disagree with allegations that it does and are deeply concerned about the health risks and confusion this poses for expecting mothers and parents."

But Kenvue has been a disappointment for investors and it's stock is down more than 23 per cent this year.

Critics say growth has stalled and the company has relied too much on its legacy brands and failed to innovate.

Industry analysts with Citi point out the poor track record for mergers involving consumer packaged goods companies.

In September, Kraft Heinz said it would break up its decade-old merger after its tie-up created one of the biggest food manufacturers on the planet.

Its net revenue has fallen every year since 2020.

Citi Investment Research analyst Filippo Falorni is concerned about the deal's size given the recent history in the sector, particularly given the challenges faced by Kenvue, which he said needs a big turnaround.

In July, Kenvue announced that chief executive Thibaut Mongon was leaving in the midst of a strategic review with the company under mounting pressure from activist investors unhappy about growth.

Kimberly-Clark chairman and chief executive Mike Hsu will be chairman and chief executive of the combined company.

Three members of the Kenvue's board will join Kimberly-Clark's board at closing.

The combined company will keep Kimberly-Clark's headquarters in Irving, Texas, but there will be significant operations around Kenvue facilities and locations as well.

The deal is expected to close in the second half of next year. It still needs approval from shareholders of both both companies.

Kenvue shareholders will receive $US3.50 ($5.35) per share in cash and 0.14625 Kimberly-Clark shares for each Kenvue share held at closing.

That amounts to $US21.01 ($32.14) per share, based on the closing price of Kimberly-Clark shares on Friday.

Kimberly-Clark and Kenvue said that they identified about $US1.9 billion ($2.91 billion) in cost savings that are expected in the first three years after the transaction's closing.

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.