RAMS sued for 'systemic misconduct' in preparing home loans

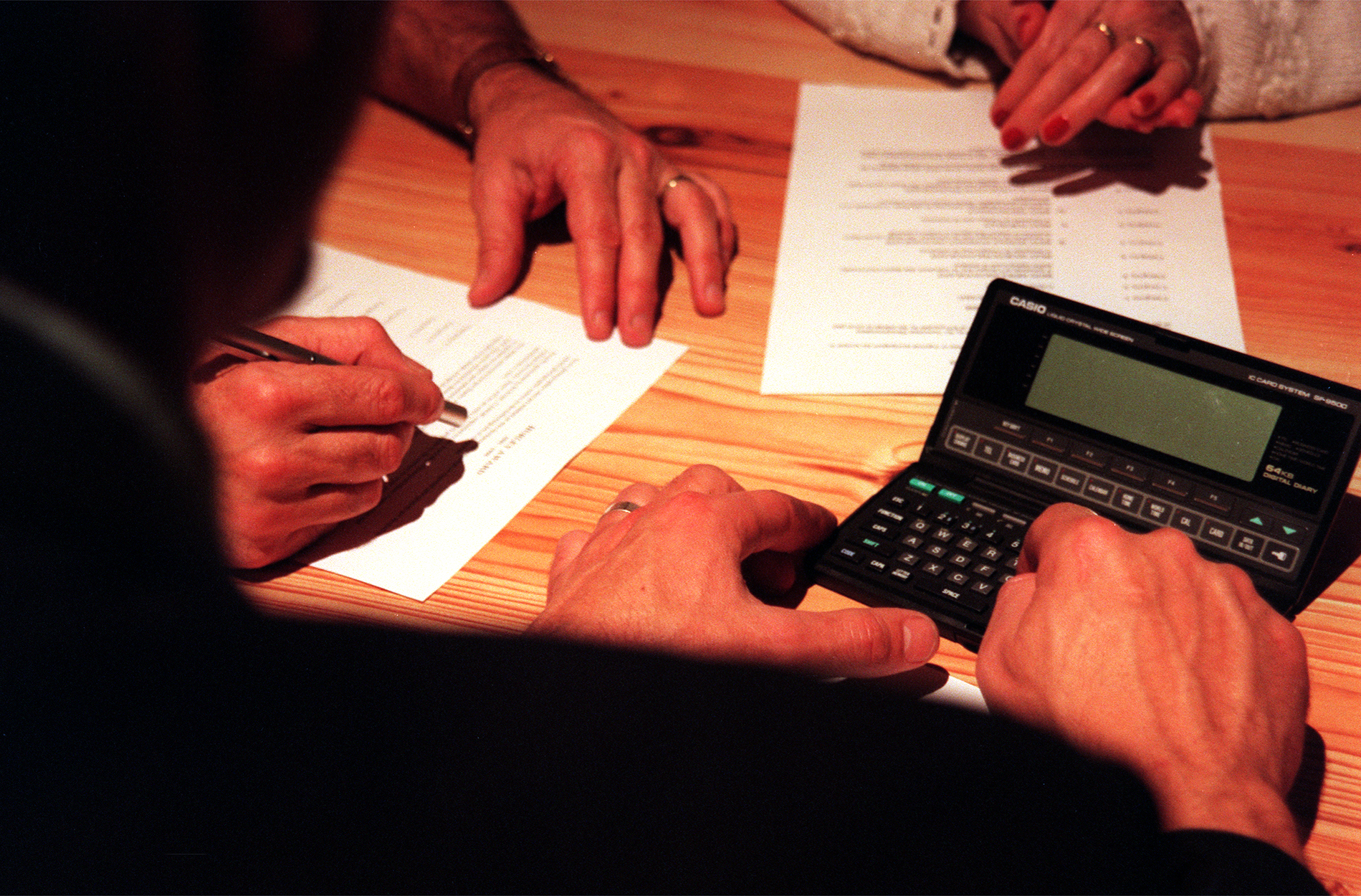

The corporate watchdog ASIC has sued RAMS Home Loans, accusing it of "systemic misconduct" in arranging home loans.

Westpac's mortgage broking subsidiary allegedly breached its obligations under credit laws and engaged in widespread unlicensed conduct between June 2019 and April 2023.

Allegations brought by ASIC include that RAMS staff forwarded fake pay slips in mortgage applications, and changed customers' expenses and debts in order to meet loan serviceability provisions.

READ MORE: Single ticket wins $70 million Oz Lotto jackpot

"This is a systemic organisational governance failure by RAMS who did not adequately supervise its franchise network," ASIC deputy chair Sarah Court said.

"RAMS allowed years of unlawful conduct to occur across its franchises, creating the opportunity for loans to be provided to customers who otherwise may not have qualified for those loans, and thereby increasing commissions earned by RAMS franchisees."

Last August, Westpac announced it was closing the RAMS brand to new home loan applicants and absorb its existing loans into the wider business.

RAMS has admitted liability for the contraventions and remediated customers impacted by the misconduct.

ASIC is seeking financial penalties and declarations against RAMS.

The date for the first case hearing is yet to be scheduled.

In an ASX statement before trading today, Westpac said it will continue to cooperate with ASIC to resolve the proceedings as speedily as possible.

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.