Aussies paying more for private health insurance and getting less

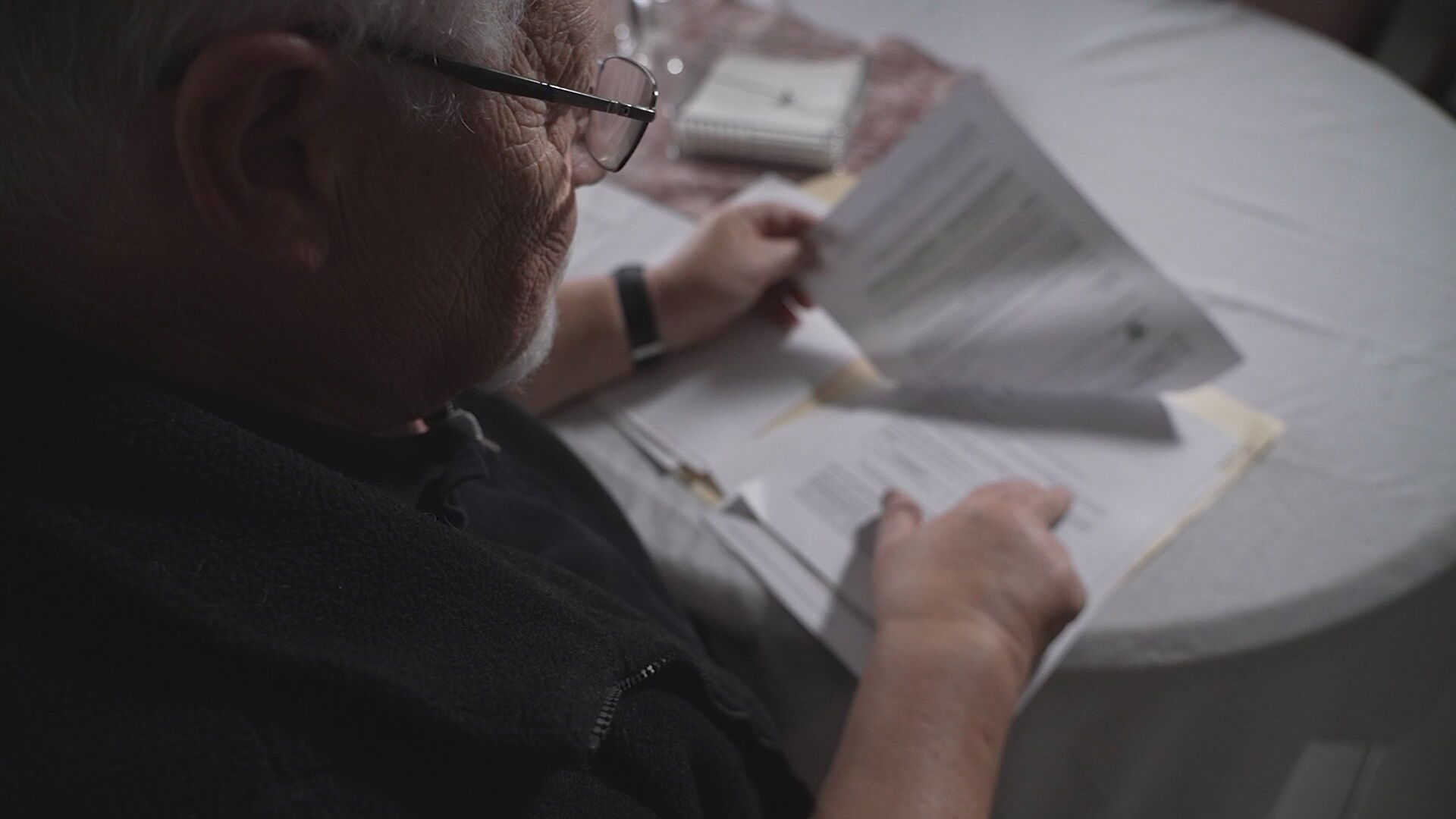

Australians are paying more for private health insurance and getting less for their money in return, a new report from the country's top doctors' advocacy group says.

The Australian Medical Association has released its latest Private Health Insurance Report Card, which found that consumers were abandoning gold-tier policies and questioning the value of other policies, while insurer profits piled up ever higher.

The AMA said the sector was in urgent need of reform, and President Dr Danielle McMullen renewed the call to establish an independent private health authority to drive that process.

READ MORE: Mortgage holders' hopes for early Christmas present all but quashed, say experts

"Australia's health system is valued for its mix of public and private healthcare, but both parts of the system are under increasing pressure," McMullen said.

"Public hospitals are struggling with a severe logjam crisis, which is pushing more patients towards the private sector.

"However, runaway insurance premiums, low value offerings and shady tactics like product phoenixing leave customers facing tough choices about the level of cover they can afford."

READ MORE: Cash boost for million-plus Aussies in just weeks

The report card showed that every year since 2008, the growth of private health insurance premiums has outstripped inflation, health sector inflation, average weekly earnings and the indexation of the Medicare Benefits Schedule (MBS).

Between 2008 and 2024, premiums climbed more than 100 per cent, while MBS indexation – which was frozen for several years from 2013 – increased by less than 20 per cent.

The report card also shows that over the six years to June 2025, insurers increased benefits paid for in-hospital medical treatment by only 18.1 per cent, while sector profits grew by nearly 50 per cent over the same period.

READ MORE: Manhunt for prisoner who escaped from police at hospital

In 2024-2025, insurers returned 84.2 per cent of premiums to consumers as benefits, below the 2019 level of 88 per cent.

The AMA is calling on the federal government to mandate a 90 per cent return minimum for insurers.

"Of course, private health insurers must make a surplus to be sustainable, but it is clear they are holding out on Australians while recording significant profits each year," McMullen said.

"These insurers have ample capacity to increase the benefits paid to patients."

The report also found gold-tier policies are in decline as consumers face rising premiums and cost-of-living pressures.

Since the start of the COVID-19 pandemic in March 2020, the number of gold-tier policies have dropped by 360,000, despite the overall number of policies growing.

"These trends show that private health insurance is becoming less affordable for many Australians – and we are already seeing the drastic effects of this, with at least 14 private maternity units closing over the past five years," McMullen said.

"The need for a Private Health System Authority to better regulate the sector and drive long-term reform has never been more crucial. There are too many bodies involved in the regulation of private health – a single, independent authority would provide a unified and coherent approach."

DOWNLOAD THE 9NEWS APP: Stay across all the latest in breaking news, sport, politics and the weather via our news app and get notifications sent straight to your smartphone. Available on the Apple App Store and Google Play.